Prescription drug insurance coverage is an integral part of your overall health insurance package. It helps you manage the high costs associated with medications and ensures that you have access to the drugs that you need for your well-being. However, understanding the details of your coverage can often be confusing and overwhelming. In this article, we will break down the components of prescription drug insurance coverage to help you make informed decisions regarding your healthcare.

Types of Prescription Drug Coverage

There are generally two types of prescription drug coverage available: stand-alone prescription drug plans (PDPs) and prescription drug coverage embedded within a comprehensive health insurance plan.

Stand-alone PDPs are sold separately from your health insurance and are primarily designed for individuals who have Medicare coverage. These plans provide coverage exclusively for prescription drugs and usually have their own premium, deductible, copayments, and formulary.

On the other hand, most comprehensive health insurance plans, such as those offered by employers, include prescription drug coverage. This coverage is integrated into the overall healthcare benefits and may have different cost-sharing arrangements.

Understanding Formularies

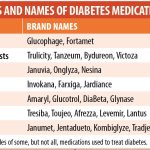

A formulary is a list of prescription drugs that are covered by your insurance provider. It categorizes medications into different tiers, each with its own cost-sharing requirements. The formulary is developed by a team of healthcare professionals who evaluate the safety, effectiveness, and cost-effectiveness of drugs.

When reviewing your prescription drug insurance coverage, it is crucial to understand the formulary and which tier your medications fall into. Drugs in lower tiers typically have lower out-of-pocket costs than those in higher tiers. If your medication is not covered by the formulary, you may need to explore alternative options with your healthcare provider or request an exception from your insurance company.

Deductibles, Copayments, and Coinsurance

Like other types of insurance coverage, prescription drug insurance often requires you to pay certain costs out-of-pocket. The most common cost-sharing components are deductibles, copayments, and coinsurance.

A deductible is the amount you must pay before your prescription drug coverage kicks in. Once you meet your deductible, you will enter the coverage period, and your insurance will begin to cover a portion of your drug costs.

Copayments are fixed amounts that you pay for each prescription or service. For example, your plan may require a $20 copayment for each visit to the pharmacy to refill your prescription.

Coinsurance, on the other hand, is a percentage of the drug cost that you are responsible for paying. For instance, if your plan has a 20% coinsurance, you would pay $20 for a $100 prescription, with your insurance covering the remaining $80.

Prior Authorization and Step Therapy

Prior authorization and step therapy are techniques used by insurance companies to control costs and ensure appropriate medication usage.

Prior authorization requires you or your healthcare provider to seek approval from your insurance company before certain medications are covered. This process typically involves providing medical justifications, such as previous treatment failure, to demonstrate the necessity of the prescribed drug.

Step therapy involves starting with lower-cost medications and progressing to more expensive options only if the initial treatments are ineffective. Your insurance provider may require you to try generic drugs or cheaper alternatives first before covering a more costly medication.

Specialty Medications

Many prescription drug insurance plans differentiate between ordinary medications and specialty medications. Specialty drugs are typically high-cost drugs used to treat complex or rare conditions, and they often require special handling or administration.

It is essential to understand how your insurance policy covers specialty medications, as they may have specific requirements, including higher copayments or the need for prior authorization. Contacting your insurance company or reviewing your policy documents can provide the necessary clarification regarding specialty drug coverage.

Conclusion

Understanding your prescription drug insurance coverage is vital for managing your healthcare costs and receiving the medications you need. By familiarizing yourself with the types of coverage available, formularies, cost-sharing components, and any additional requirements for specialty medications, you can make informed decisions about your healthcare and optimize the benefits provided by your insurance plan. If you have any questions or concerns, reach out to your insurance provider for personalized assistance.